How to Declare Wealth TSC

Are you Looking for How to Declare Wealth TSC 2025? Let’s Dive into The Complete Online Guide for Teachers

Every teacher under the Teachers Service Commission must submit their wealth declaration in 2025. Many teachers still struggle with the online process. This guide explains how to declare wealth TSC using the updated systems. It also highlights key changes for the 2025 declaration cycle.

TSC introduced a fully digital process several years ago. Today, teachers must use the TSC wealth declaration portal for every exercise. This process promotes transparency, accountability, and integrity across the teaching profession. It also supports national efforts against corruption.

The 2025 declaration is mandatory for all teachers. Every public officer must reveal their income, assets, and liabilities. This blog explains how to declare wealth TSC 2025 using simple steps.

Understanding TSC Wealth Declaration Requirements

TSC conducts wealth declaration every two years. The next cycle is TSC wealth declaration 2025. Teachers must declare all income received during the period. They must also disclose assets they own. Liabilities must also be included.

The wealth declaration supports ethical public service. It ensures every teacher remains accountable. The process also protects teachers from future disputes. Many teachers ask, “Is TSC wealth declaration open?” The portal usually opens in November.

Teachers must use tsc wealth declaration online systems to complete the exercise. Hardcopy forms are no longer accepted. The process uses secure digital verification.

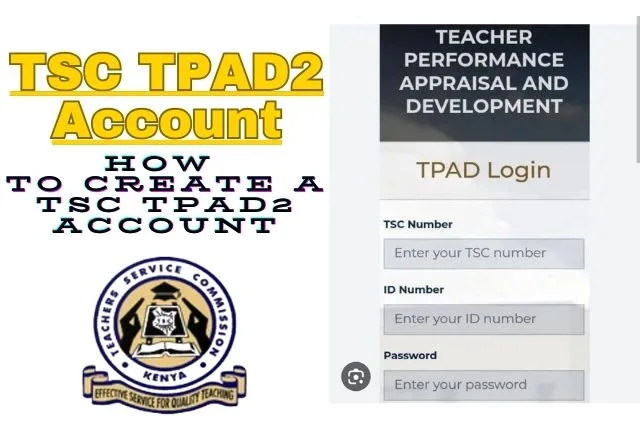

Platforms Required for the Declaration

Teachers must use several official platforms. The most important platform is the TSC online portal. This portal hosts many TSC online services. The wealth declaration tool is one of them.

Teachers also use TPAY during income verification. TPAY helps teachers confirm their payslips. It also provides financial details needed for the declaration.

Access begins through the official website, www.tsc.go.ke. The website links to the tsc online workspace. It also directs teachers to teachers online services. These services support registration, transfers, and wealth declaration.

How to Declare Wealth TSC 2025 (Step-by-Step Guide)

Here is the full process of how to declare wealth TSC online. Each step follows the official procedure.

Step 1: Access the TSC Online Portal

Open your browser and visit www.tsc.go.ke. Click the TSC online tab. Locate TSC online services. Open the link labeled Wealth Declaration. This leads directly to the tsc wealth declaration portal.

Enter your TSC number and password. Reset your password if you forgot it.

Step 2: Open the Wealth Declaration Page

Once logged in, click on the wealth declaration section. Select “Bi-Annual Declaration”. This option opens the declaration form. The system displays your basic details. Confirm every detail carefully.

Ensure your school, address, ID number, and designation are correct. Correct any wrong information before proceeding.

Step 3: Confirm Teaching Subjects and Qualifications

The system asks for your teaching subjects. Choose the correct area. You may select sciences, arts, humanities, or technical areas. Indicate your training grade. Most teachers select pass, credit, or distinction.

Step 4: Gather Your Income Figures from TPAY

To complete the income section, you must check your payslips. Open TPAY. Log in using your TSC number and password. Click the P9 form. This form provides your yearly income summary.

The 2025 declaration focuses on two years. Teachers must capture income from previous years. This includes salaries for each month. Some teachers use approximate income based on payslip averages.

Open your payslips for all relevant months. Record your total earnings. Include allowances listed under total income. These figures help complete the income section correctly.

Step 5: Declare Your Income on the Portal

Return to the tsc wealth declaration portal. Under income, write “Salary.” Insert your total earnings. This includes all pay from the two-year cycle.

The amount must reflect your total approximate income. Ensure the figure matches your TPAY details.

Step 6: Declare Your Assets

The asset section is important. Many teachers forget this part. List every asset you own. This includes land, houses, vehicles, and shares.

Most teachers also include SACCO shares. These appear clearly on the October payslip. The amount appears within brackets. Insert the correct amounts.

Include any insurance savings or policies. Note the company name and saved amount. The wealth declaration TSC online portal requires accurate details.

Step 7: Declare Your Liabilities

The next section captures liabilities. These include bank loans and SACCO loans. Open your latest payslip again. Locate the liabilities amount inside brackets. Insert this figure under liabilities.

Write the name of the lender. The figure must represent the remaining balance.

Step 8: Add Details of Your Dependents

The system asks teachers to declare dependents. This section includes children below 18. Insert their full names and gender.

The spouse section is optional. Teachers can include or ignore it. If you include your spouse, you must also declare their wealth.

Step 9: Add Witness Information

Every teacher must have a witness. Choose a colleague, friend, or trusted professional. Insert their ID number and full names. Confirm the details before saving.

Step 10: Review and Submit the Declaration

Tick the declaration confirmation box. This confirms your information is true. Review the summary carefully. Click submit when ready.

The system sends a confirmation message. Teachers also receive an SMS. This confirms successful completion.

Why Teachers Must Declare Wealth Early

Last-minute submissions cause portal delays. Many teachers struggle when systems slow down. Early declaration prevents technical issues. It also ensures compliance with regulations.

Teachers should visit teachers online regularly. This ensures smooth portal access. Regular checks improve account readiness.

Conclusion

Understanding how to declare wealth TSC 2025 is now simple. Teachers only need TPAY details, accurate records, and portal access. The tsc online portal remains the main platform for wealth declaration. Completing the process early reduces stress. Every teacher must comply to avoid disciplinary action.

This guide ensures teachers complete the tsc wealth declaration 2025 online correctly. Use the steps above to finish your declaration smoothly and confidently.