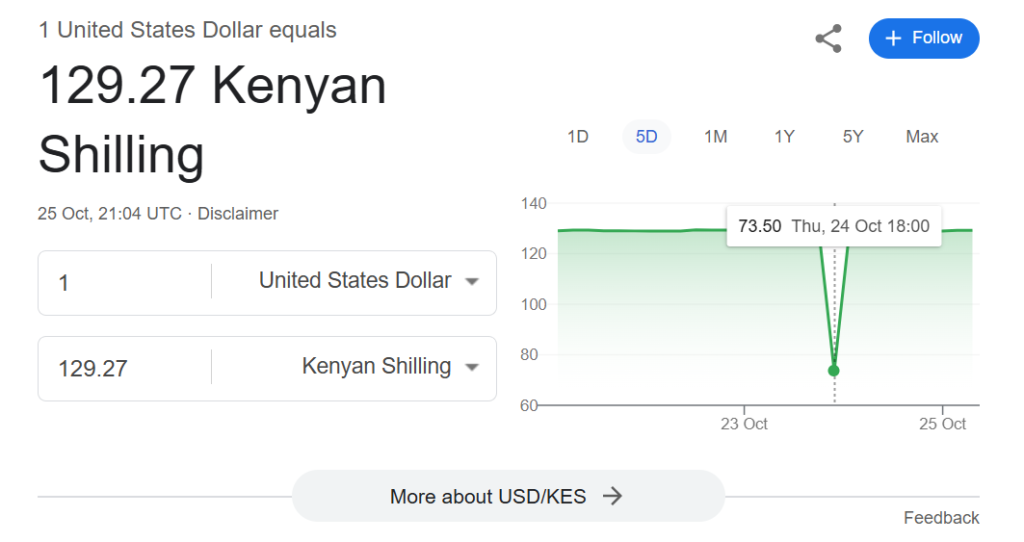

Dollar to Shilling

Currency exchange rates between the U.S. dollar (USD) and the Kenyan shilling (KES) often experience rapid fluctuations that can impact everything from the cost of imports to everyday expenses. These fluctuations may seem random, but they’re driven by multiple economic factors, both local and international.

On 24th October, witnessed a sudden dip in the USD to KES exchange rate created an unexpected opportunity for many investors. The dollar briefly plummeted from 129 to 73 Kenyan shillings, allowing savvy traders to capitalize on the temporary drop. Those who quickly bought dollars during the dip and sold once the rate stabilized back around 129 KES saw substantial gains in just a short period. This kind of fluctuation underscores the volatility of forex markets and the potential for both quick profits and risks.

Why Dollar to Shilling Currency May Fluctuate

Here are the primary reasons why the dollar-to-shilling exchange rate may fluctuate throughout the day and even return to a previous level within an hour.

1. Relative Currency Strength and Market Demand

Relative currency strength is a fundamental factor in exchange rates, especially between the U.S. dollar and the Kenyan shilling. Exchange rates depend heavily on the demand and supply of each currency in the forex market. When demand for the dollar rises perhaps due to international trade requirements, investment movements, or financial market volatility the value of the dollar tends to strengthen relative to other currencies, like the shilling. Conversely, if there’s an increased demand for the Kenyan shilling (such as when Kenyan exporters convert earnings back into shillings), the value of the shilling may momentarily rise against the dollar.

Forex markets are open 24 hours, and large buy-sell orders can result in quick fluctuations. Therefore, the market can see the dollar-to-shilling rate move up or down in a matter of minutes, based on who’s buying or selling and in what quantities.

2. Global Economic Factors and Events

International events also influence exchange rates in real-time, as investors constantly reassess currency values in light of news and data. For example, a sudden shift in U.S. economic policy, or an announcement from the Federal Reserve regarding interest rates, can cause the dollar to rise or fall sharply.

The Kenyan shilling is sensitive to global trends, especially due to Kenya’s dependency on imports and foreign investment. If global oil prices fluctuate or there’s news affecting global trade policies, the shilling may experience rapid changes in value.

Emerging markets, including Kenya, can be affected by events tied to the BRICS nations (Brazil, Russia, India, China, and South Africa), which hold substantial influence on the global stage. Any major economic moves by BRICS—such as changes in their policies on oil trade or investment strategies in Africa—can indirectly impact the shilling’s performance against the dollar.

3. Local Economic Performance

The health of Kenya’s economy plays a significant role in the USD-KES exchange rate. Kenya’s gross domestic product (GDP), inflation rates, interest rates, and the general business environment all contribute to the shilling’s strength.

For instance, if Kenya’s economy is performing well, foreign investors may see it as a favorable environment and invest in Kenyan assets, driving demand for the shilling. In contrast, if inflation is high or the economy is struggling, foreign investors may shy away, leading to a weakened shilling.

The Central Bank of Kenya (CBK) also plays a role in stabilizing the currency, often intervening to ensure the shilling doesn’t depreciate rapidly against the dollar. However, while the CBK can make adjustments, external factors usually have a stronger influence on day-to-day fluctuations.

4. Political Stability and Socioeconomic Events

Political stability or instability within Kenya or the United States can lead to changes in the dollar-to-shilling rate. Uncertain political situations may create hesitation among foreign investors, leading to reduced demand for the Kenyan shilling.

For instance, election seasons, policy changes, or civil unrest can drive up the demand for stable currencies like the dollar, which in turn depreciates the shilling.

A similar effect occurs when there are significant developments in other East African currencies, like the South Sudanese Pound, Tanzanian Shilling, or the Ethiopian Birr.

If a neighboring country faces economic turmoil, investors might shift their focus, causing fluctuations in local currencies, including the KES, due to cross-border economic dependencies.

5. Speculation and Forex Trading Behavior

Forex traders regularly buy and sell currencies based on anticipated price movements, contributing to fluctuations in the dollar-to-shilling rate.

This speculative trading can sometimes cause sharp, short-lived fluctuations in the exchange rate, especially if major investors make trades in large volumes.

For example, a trader might predict that the dollar will strengthen in the short term and purchase it, leading to a quick rise in its value.

If they sell the dollar soon after, the exchange rate could return to its previous level, making it seem as though the rate has fluctuated without reason. This speculative behavior can cause volatility even when there are no significant underlying economic factors.

6. Global Commodity Prices

Kenya relies heavily on imports for key commodities, including oil, and changes in global commodity prices have an impact on the shilling’s value.

Since oil is traded internationally in dollars, an increase in oil prices often leads to higher demand for dollars as Kenyan importers buy more of the currency to pay for imports. This increased demand can drive up the dollar’s value relative to the shilling.

Additionally, fluctuations in the prices of agricultural commodities, which are Kenya’s main exports, can impact the shilling’s value.

If global prices for coffee, tea, or flowers decrease, exporters earn less, potentially reducing foreign currency inflows and weakening the shilling against the dollar.

7. Central Bank Policies in Both Countries

Both the U.S. Federal Reserve and the Central Bank of Kenya can influence currency values by adjusting monetary policies. The Federal Reserve, for instance, uses tools like interest rates to either strengthen or cool down the U.S. dollar.

If the Fed raises interest rates, the dollar becomes more attractive to investors, which often leads to the shilling weakening against the dollar. Conversely, if the CBK raises interest rates, this could attract investors to Kenya, potentially strengthening the shilling.

However, such policy adjustments are complex, and their effects on the forex market may vary based on how investors perceive long-term versus short-term economic stability. Because of this, rate adjustments from central banks can lead to immediate, yet sometimes temporary, fluctuations in the dollar-to-shilling exchange rate.

In Summary

The exchange rate between the dollar and the shilling can fluctuate due to a variety of factors, including economic fundamentals, local and global events, and speculative trading.

Each factor plays a role in determining currency value, and some, such as global commodity prices and central bank policies, can trigger rapid shifts within minutes or hours.

While fluctuations can seem unpredictable, they are rooted in the interplay between supply and demand, economic indicators, and investor behavior.

Understanding these factors helps illuminate the reasons behind the up-and-down patterns of currency exchanges and the impact these fluctuations can have on Kenya’s economy.