M-Pesa Charges

Are you Looking for M-Pesa Charges 2025? Here’s an Updated Sending, Withdrawal, and Transaction Fees for M-Pesa in Kenya

M-Pesa remains Kenya’s most used mobile money platform. Many Kenyans depend on it for payments, savings, and transfers. Understanding M-Pesa charges helps you plan better and avoid unexpected fees. Safaricom reviews these charges often to align with economic changes and regulatory guidelines. This guide explains the new M-Pesa charges, including sending fees, withdrawal fees, Paybill costs, and bank transfer charges.

Overview of M-Pesa Charges in 2025

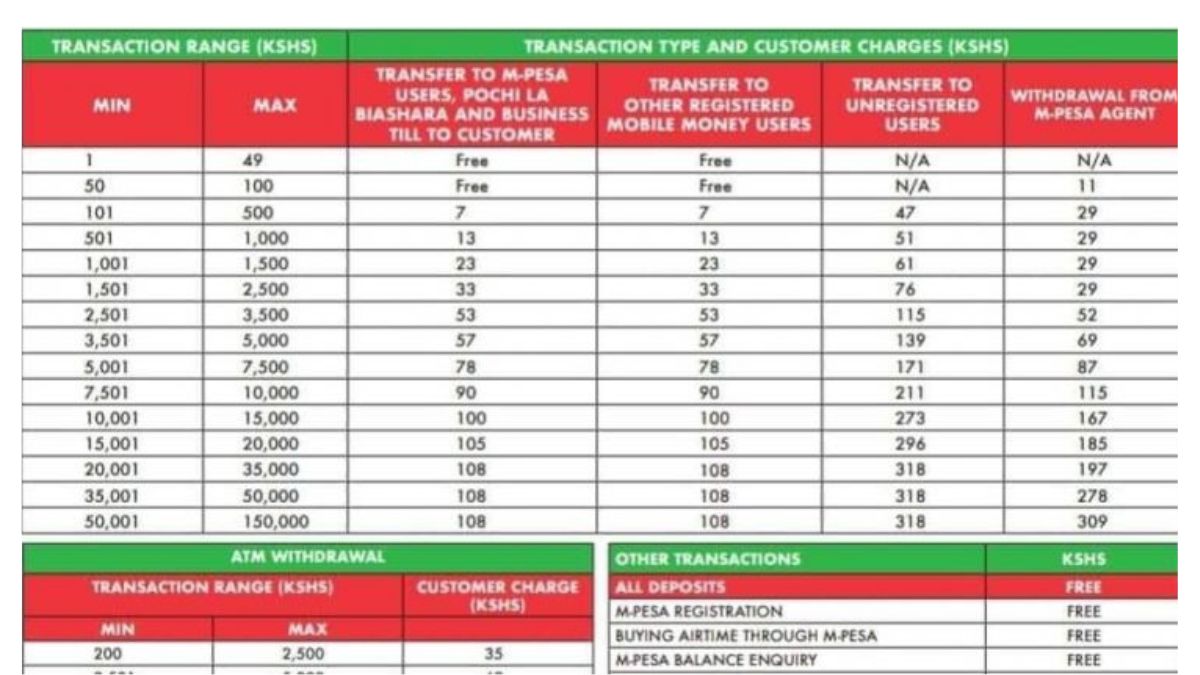

The M-Pesa transaction charges 2025 cover sending money, withdrawing cash, and paying bills. Safaricom publishes these updates through the M-Pesa charges PDF shared annually. The current M-Pesa charges chart helps customers budget and choose cheaper transfer methods. Charges depend on the transaction amount and the service used.

M-Pesa Charges Sending Money in 2025

Sending money through M-Pesa attracts different fees depending on the transfer type. Transactions to registered users cost less than transfers to unregistered users.

Here is how M-Pesa charges sending money generally work:

- Sending money to registered users is cheaper.

- Sending money to unregistered users costs more.

- Transactions above KSh 1,000 cost higher fees.

- Transactions below KSh 100 remain free.

Safaricom maintains affordable person-to-person rates to encourage mobile transfers. These charges may appear on the M-Pesa charges chart 2025.

M-Pesa Sending Money Charges Breakdown

Below is the general structure for 2025:

- KSh 1–100: Free

- KSh 101–500: Small fee applies

- KSh 501–1,000: Higher fee applies

- KSh 1,001 and above: Tiered charges apply

The exact figures appear in the M-Pesa charges 2025 PDF Kenya, which Safaricom releases yearly. Reviewing the document helps you understand new adjustments.

M-Pesa Withdrawal Charges 2025

Withdrawal fees remain among the most asked about. M-Pesa charges withdrawal depend on the amount withdrawn from an agent. Higher withdrawals attract higher fees. Safaricom also evaluates market trends before adjusting withdrawal fees.

M-Pesa Withdrawal Charges Breakdown

Here is the general withdrawal structure:

- Withdrawals below KSh 100 remain free.

- Withdrawals between KSh 101 and KSh 2,500 attract moderate fees.

- Higher amounts above KSh 2,501 attract higher fees.

The M-Pesa withdrawal charges document outlines the official fee allocation for each band. Always check the official chart or download the PDF for accuracy.

M-Pesa Withdrawal Charges Chart

Safaricom provides a current M-Pesa charges chart for easy reference. The chart displays fee bands for sending and withdrawal processes. You can compare different amounts quickly. The M-Pesa withdrawal charges chart 2024 helped users track earlier fees. A new version for 2025 continues this convenience.

You can access the official chart through the Safaricom website or the M-Pesa charges PDF.

New M-Pesa Charges Introduced for 2025

Every year introduces changes. The new M-Pesa charges may include revised sending fees, updated withdrawal fees, and fresh limits. Safaricom aligns these adjustments with regulatory conditions and market needs. The 2025 updates focus on affordable digital transactions.

Some of the new trends include:

- Updated fees for higher transfer bands.

- Revised withdrawal fees for agent transactions.

- New limits for transaction caps.

- Updated Paybill tariffs for business payments.

The official publications confirm these adjustments.

M-Pesa Paybill Charges Explained

Many businesses use Paybill numbers to receive payments. M-Pesa paybill charges depend on the amount paid and the receiving company’s negotiated tariffs. Paybill transactions between KSh 1 and KSh 100 remain free. Larger payments attract tiered costs.

Paybill charges differ from person-to-person charges. The 2025 changes may include revised business tariffs.

M-Pesa Charges for Bank Transfers

Kenyans frequently transfer money between bank accounts and M-Pesa. These transactions attract specific charges.

Equity to M-Pesa Charges

Equity Bank offers free transfers for selected bands. Other bands attract small fees. These fees may change based on seasonal updates.

KCB to M-Pesa Charges

The KCB transfers to M-Pesa include small charges, especially for higher amounts. KCB may update these charges during system reviews. Always check your banking app for updated fee structures.

Paying for Services Using M-Pesa

Some services include separate charges when paying through M-Pesa. For example, SGR online booking via M-Pesa charges apply when booking tickets through the portal. These charges depend on ticket prices and the SGR billing system.

Many companies structure charges by adding small convenience fees or fixed costs. Safaricom’s fee review influences these payments.

M-Pesa Charges for Sending KSh 1,000

People often search for sending 1000 via M-Pesa charges. Sending KSh 1,000 to a registered user attracts a moderate fee. Sending the same amount to an unregistered user costs more. The updated 2025 rates appear on the official chart.

Customers can also check their app for real-time fees before confirming a transaction.

Read Also: How to Reverse M-Pesa

M-Pesa Transaction Charges Comparison for 2024 and 2025

Many users compare M-Pesa charges 2024 and M-Pesa charges 2025. The 2024 chart helped users understand older fee structures. The 2025 chart reflects new adjustments. Safaricom improved several bands to support digital growth.

The M-Pesa charges 2024 PDF still circulates online, but customers should use the updated 2025 version for accuracy.

Where to Download the M-Pesa Charges 2025 PDF Kenya

Safaricom publishes official documents through their website. The M-Pesa charges 2025 PDF Kenya includes sending charges, withdrawal fees, Paybill tariffs, and bank transfer costs. You can download the file for easy reference.

To access the PDF:

- Visit the Safaricom official site.

- Open the M-Pesa section.

- Download the latest charges document.

The M-Pesa charges PDF updates yearly.

Tips to Reduce Your M-Pesa Charges

You can reduce costs using simple strategies:

- Send money only to registered users.

- Withdraw larger amounts at once.

- Use bank transfers when cheaper.

- Use Paybill only when required.

- Confirm fees before completing transactions.

These steps keep your finances predictable.

Final Thoughts

Understanding M-Pesa charges helps you plan your transactions wisely. The M-Pesa transaction charges 2025 offer clear structures for sending and withdrawing money. Always refer to the current M-Pesa charges chart or download the official M-Pesa charges 2025 PDF Kenya for accuracy. The 2025 adjustments support transparent, affordable, and efficient mobile money services for all Kenyans